Elevate Your Banking Experience With Credit Scores Unions

Exploring the world of banking experiences can often cause finding hidden treasures that supply a refreshing departure from standard banks. Credit report unions, with their focus on member-centric services and community involvement, present an engaging choice to conventional financial. By focusing on private requirements and fostering a sense of belonging within their membership base, lending institution have actually sculpted out a niche that reverberates with those looking for an extra individualized approach to managing their funds. Yet what sets them apart in regards to elevating the financial experience? Let's dive deeper into the distinct advantages that cooperative credit union offer the table.

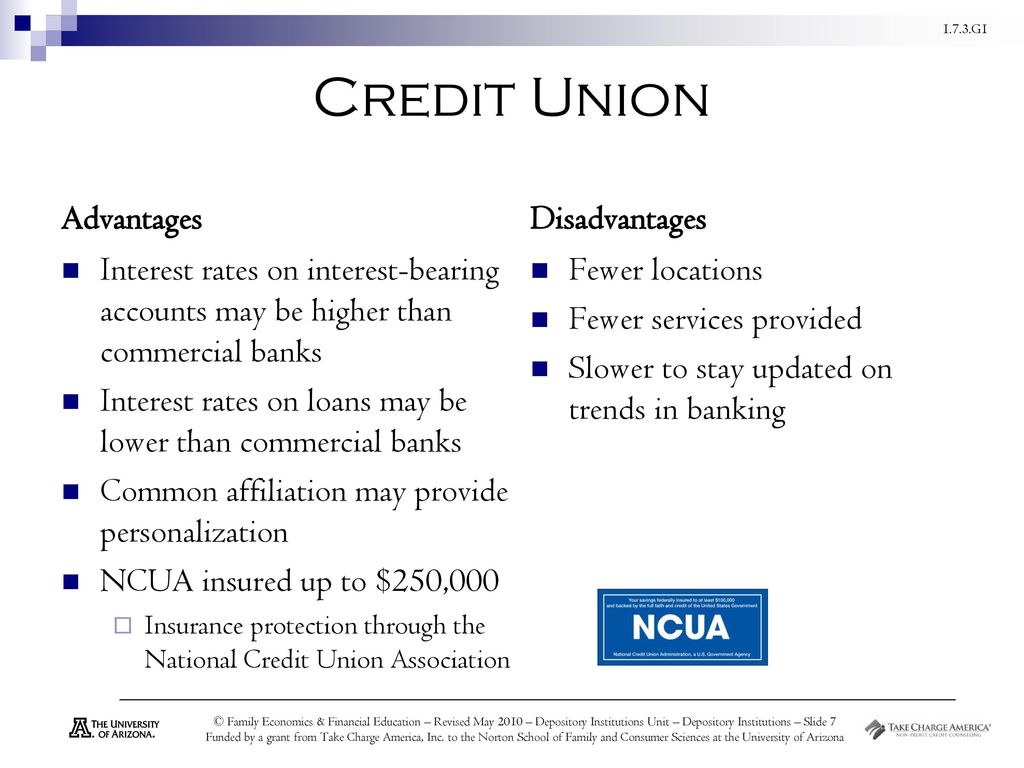

Benefits of Lending Institution

One more benefit of cooperative credit union is their autonomous structure, where each participant has an equal enact electing the board of directors. This guarantees that decisions are made with the ideal rate of interests of the members in mind, as opposed to focusing exclusively on maximizing revenues. Furthermore, credit unions commonly use monetary education and learning and counseling to help members enhance their monetary literacy and make informed decisions about their cash. In general, the member-focused technique of credit unions sets them apart as establishments that prioritize the well-being of their neighborhood.

Subscription Requirements

Credit unions normally have particular requirements that people have to satisfy in order to end up being members and gain access to their financial solutions. Membership requirements for cooperative credit union commonly entail eligibility based upon elements such as a person's area, employer, organizational affiliations, or various other certifying connections. As an example, some lending institution may serve individuals that live or work in a particular geographical location, while others may be affiliated with certain firms, unions, or associations. Additionally, member of the family of present lending institution members are commonly qualified to join as well.

To come to be a member of a cooperative credit union, individuals are generally needed to open an account and maintain a minimum down payment as defined by the organization. Sometimes, there may be single subscription charges or recurring subscription dues. When the membership criteria are satisfied, individuals can delight in the advantages of belonging to a lending institution, consisting of accessibility to individualized monetary solutions, affordable rates of interest, and a concentrate on member fulfillment.

Personalized Financial Solutions

Customized financial solutions customized to specific needs and choices are a trademark of cooperative credit union' dedication to member contentment. Unlike typical banks that usually provide one-size-fits-all services, debt unions take a more customized method to managing their participants' financial resources. By understanding the one-of-a-kind goals and scenarios of each participant, cooperative credit union can provide tailored referrals on cost savings, investments, finances, and various other monetary products.

Additionally, cooperative credit union normally provide lower fees and affordable rates of interest on finances and savings accounts, further boosting the individualized financial services they give. By concentrating on private demands and supplying customized remedies, lending institution set themselves apart as relied on economic partners dedicated to aiding members flourish financially.

Area Participation and Support

Neighborhood engagement is a cornerstone of credit history unions' goal, reflecting their commitment to supporting local campaigns and fostering purposeful links. Cooperative credit union proactively join neighborhood occasions, sponsor neighborhood charities, check it out and organize economic literacy programs to enlighten non-members and members alike. By purchasing the communities they offer, credit history unions not only reinforce their relationships but likewise add to the total health of culture.

Supporting small companies is one more way lending institution demonstrate their dedication to neighborhood neighborhoods. Through using little business fundings and monetary suggestions, cooperative credit union aid business owners thrive and promote financial development in the location. This assistance exceeds just monetary support; credit unions typically offer mentorship and networking opportunities to assist small companies prosper.

Moreover, lending institution often involve in volunteer job, urging their employees and members to repay through various social work tasks - Credit Union in Wyoming. Whether it's taking part in local clean-up occasions or organizing food drives, lending institution play an energetic duty in boosting the lifestyle for those in requirement. By prioritizing area participation and assistance, cooperative credit union absolutely symbolize the spirit of cooperation and shared support

Online Banking and Mobile Applications

Credit scores unions are at the center of this digital transformation, offering members practical and safe and secure ways to manage their finances anytime, anywhere. Online banking services offered by credit report unions enable members to examine account equilibriums, transfer funds, pay expenses, and check out purchase background with just a few clicks.

Mobile apps used by credit history unions even more improve the financial experience by providing added versatility and availability. Overall, credit scores unions' on the internet financial and mobile applications equip participants to handle their funds efficiently and safely in today's busy electronic world.

Conclusion

In final thought, debt unions supply an one-of-a-kind financial experience that prioritizes area participation, individualized service, and member satisfaction. With lower costs, competitive passion rates, and customized economic solutions, credit history unions cater to individual requirements and advertise financial wellness.

Unlike banks, credit history unions are not-for-profit companies had by their members, which commonly leads to decrease charges and much better interest prices on savings accounts, fundings, and debt cards. Additionally, credit history unions are understood for their customized consumer solution, with personnel participants taking the time to recognize the special economic goals and great post to read difficulties of each participant.

Credit unions usually provide monetary education and learning and counseling to aid participants enhance their monetary proficiency and make notified choices concerning their cash. Some credit history unions might serve people that live or work in a specific geographic location, while others might be connected with certain companies, unions, or organizations. In addition, household participants of present credit report union participants are typically eligible official website to sign up with as well.

Comments on “Discover Top Credit Unions in Wyoming: Your Guide to Financial Solutions”